How Gratitude Helps You Retire Early

GRATITUDE AND GLUTTONY

It's the weekend of Thanksgiving and Black Friday, that wonderful time when we look inward to appreciate the things we have, and then immediately express our newfound sense of gratitude by stuffing ourselves and binge shopping as much as we possibly can. It's like food gluttony followed by financial gluttony.

It's ironic that we express thankfulness for what we have, and then empty our bank accounts buying stuff like there is no tomorrow - as if we don't actually feel like we are happy with what we do have.

So, in honor of our nation's day of gratitude, I'm gonna blog about how gratitude ties into personal finance (predictable, I know). And you know what? I definitely think gratitude and financial success are interconnected.

I believe that in the grand scheme of building wealth, your sense of gratitude can affect, even pervade, all of your money decisions.

Specifically, I'd like to posit the idea that being more grateful could increase your ability to reach your financial goals, and even retire early. If retiring early isn't something you've considered a viable financial goal, I hope this Wealth Mode blog post makes you reconsider.

The common misconception is that early retirement is only for the mega-rich. We've all heard of someone's rich uncle who hit it big in a business or a high-risk investment and retired at age 40, going to the country club every weekend and traveling the world every month.

Beyond the leisure-indulged lifestyle we often associate with early retirement, I think what appeals to most of us is just having more time. Time to do what we love, time to spend with family and friends. When we think about how much of our lives we spend working at a job, nothing should sound better than being able to take 5, 10, or even 15 more years of your life back by not having to work? This is, of course, assuming your job isn't literally the #1 thing you would do in your free time, which doesn't apply to most of us even though we may enjoy our work.

Retiring early isn't only achieved by making tons of money. It's achieved by having enough awareness of what really makes you happy from day to day - and gratitude definitely helps with that. Gratitude helps us overcome consumer gluttony - overspending on things that don't really bring us more value, satisfaction, or happiness.

THE PROVEN EFFECTS OF BEING GRATEFUL

The scientific research behind gratitude is impressive. While there are many opinions on what happiness is and how it is obtained, oodles of research point to a few major, predictable things: relationships, health, time. Our feelings of happiness and satisfaction in life have a lot to do with our day-to-day mood, which is obviously affected by the quality of your connection to others (relationships), how you're feeling (health), and whether you have the availability get to do things you enjoy (time). You can own all the toys and gadgets in the world but if we feel crummy, have to do things we don't like or be around people we don't like for 8 hours a day, it's hard to stay feeling happy.

In the book Thanks: How Practicing Gratitude Can Make You Happier, psychologist Robert Emmons details the impressive benefits of gratitude. In addition to all-around improvements like increased number of relationships, sleeping better, feeling more positive emotions, and strong immune systems, the book also notes:

Our groundbreaking research has shown that...the practice of gratitude as a discipline protects people from the destructive impulses of envy, resentment, greed, and bitterness.

Whew! That's heavy stuff. Gratitude ain't to be taken lightly. You've probably experienced this yourself, but we as humans have a strong tendency to want, or think we need, whatever we don't have. This propensity forces it's way in to our being without any clear judgment process as to whether or not it will actually add happiness or satisfaction - we just...want stuff.

And don't think that if you "just made a little more money" that you'd be immune to wanting more. In a mind-blowing survey of millionaire households,

Half of households between $1-5 million in net worth (and 63% of them that have kids) said that one major setback - like a job loss or market crash - would have a significant impact on their lifestyle that would be hard to recover from.

A whopping 52% of them said that they feel they wouldn't be able to keep up their lifestyle if they cut hours at work.

Almost 50% of millionaires 55 and younger said they still feel pressure to "fit in", keep up with the Jones's, and live up to others' expectations of what kind of lifestyle they should have

It's easy for us to look at "the wealthy" and judge them for it, but if we take an objective look at humanity, we can realize that more money, more wealth, more stuff, and more consumption of goods and services does not perfectly correlate with the feeling of having enough. We're hard to satisfy unless we conscientiously practice gratitude.

If you find yourself susceptible to the feeling of not having enough, know that living in today's world doesn't make it easy.

We live in an environment that bombards us with messages that our life lacks enjoyment or pleasure because of the things we don't have or aren't experiencing. The average adult is exposed to thousands of brands every day, if you count every food item in your pantry and every branded piece of clothing in your closet. Most of that is subliminal and doesn't get registered consciously, but still, you come across as many as 362 actual advertisements per day and consciously register over 150 of them! Chances are most of those 150 ads are things you don't have, or you're being persuaded to have again (any daily soda drinkers out there?).

Like it or not, you're impacted by the things you consume mentally. The messages you're exposed to can build up and affect your emotions, unless you are intentional in countering it. That's why I like Dr. Emmon's book: he turns gratitude into an action - "practicing" gratitude.

And thus, practicing gratitude can be a strong antidote for feeling like we need "more."

Now that we've established how a plentitude of gratitude can affect your ongoing feeling of happiness, let's move on to how that translates to life-changing financial decisions, even the possibility of early retirement.

THE ONE EQUATION THAT MATTERS IN PERSONAL FINANCE

There is only one equation that really matters in personal finance.

Yeah, I'm a financial planner. I'm definitely proud of all the complex formulas and ratios and theoretical investing frameworks that I've learned in order to do my job. Sharpe ratios, beta, portfolio correlations, tax calculations, measuring investment returns, so fun right?!

Those things are important, but kind of in the same way that a deep understanding of brain structure is important to a medical professional interpreting an MRI, but not that important to the patient, who just needs to know what's wrong in their noggin and what should be done to fix it.

On that note, the most important equation of financial success is simple and practical. It goes like this:

INCOME - SPENDING = SAVINGS RATE

Savings Rate = Whether Or Not You Go Anywhere Financially.

Basically, it doesn't really matter how much money you make. What matters is how much money you keep.

I know, I know. That sounds too simple. No one likes to think that their long-term financial success depends mostly on their savings rate. People would rather find the secret investing strategy, win the Powerball, hit it big by taking part-ownership in cousin Jerry's high-end collectibles pawn shop business, or be like the internet bloggers who brag about lucrative online businesses that bring in 5-digit monthly passive income.

In other words, people want to take shortcuts. Greedily, we're emotionally drawn toward the possibility of putting in very little work for very large rewards.

I'm not saying that it's wrong to seek for potentially profitable opportunities outside the "slow-and-steady" path to building wealth. But all things must be in balance.

In the end, it matters not how much you make, but how much you keep. (Have you read about the research they've done on lottery winners? Most of them end up broke and less happy than before they won.)

THE CONTROLLABLE HALF OF THE EQUATION

Back to the equation: Income - Spending = Savings Rate.

For the most part, our ability to control the front part of the equation, our income, has its limitations. We don't have complete control over how much our boss chooses to pay us, how often we'll get raises, or how much those raises will be. We can certainly make efforts to influence how much we make, like being a good employee to increase the likelihood of landing the next promotion or investing in our human capital by going college to get into a higher-paying career. But ultimately, exactly how much income we make is not completely our choice, because it usually involves someone else's decision.

There is something you should understand about the other half of the equation, though, and if you truly understand it, it should be empowering:

You have complete control over your expenses - how much you spend.

Yeah, you know what's comin'. It's the "Needs vs. Wants" discussion you've heard before, and there's no getting around it. Some things are actual needs - things absolutely necessary for survival. Other expenditures are wants, though we are just so adeptly skilled at justifying why they're actually needs.

When we are truly honest with ourselves, the baseline level of expenses we truly need to live comfortably is often lower than how we're living. Speaking candidly, anything above and beyond what it truly takes to have the necessities of life (needs) are spending decisions we make that enhance our lifestyle (wants).

Take a moment to absorb the following:

It's often said that if you have food in your fridge, clothes on your back, and roof over your head to sleep under, you are richer than 75% of the world (I'll be honest, I can't find a legitimate source for that, but it sounds good so I'm rollin' with it) :)

You only need a net worth of $3,210 to be the upper 50% of wealthiest people on earth (this one's real)

If you own a smartphone, you have a privilege that 72% of the world's population doesn't (also real)

Looking at these statistics totally changes my perspective. It makes a Frosty run to Wendy's look like a luxury treat. It turns cable TV into on-demand entertainment worthy of a king.

REDUCING YOUR SPENDING HAS A LARGER IMPACT THAN INCREASING YOUR INCOME

There is something incredibly powerful about choosing to live without something that's not a necessity, and invest that money instead.

That's because every dollar you don't spend is 1) an extra dollar to invest and 2) a permanent decrease on the amount you'll need for the rest of your life.

In personal finance this concept is often called the "Latte Factor", referring to Americans' great penchant habit spending more dollars on coffee than we get ours of sleep at night. The point being, if you spend $20 a week on coffee, choosing to cut your consumption of that particular habit in half could be an extra $520 a year you have to invest, every year for the rest of your life.

Identifying whatever your "Latte Factors" are and choosing to be grateful for what you have can lead to a dramatic reduction in future spending, redirecting dollars to invest.

Now, let's use Networthify's Early Retirement Calculator to make the "WOW" factor come across.

BEING GRATEFUL + REDUCING SPENDING = EARLY RETIREMENT

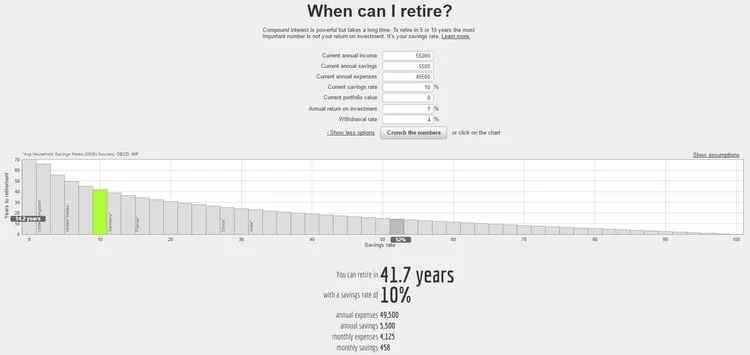

Let's say you have a $55,000 annual income, and your savings rate is 10%. This means that your spending rate is 90%, because whatever you don't save, you spend. From that perspective, there are only two things you do with money; you spend it, or you save/invest it to spend it later. If we assume that you can earn a 7% portfolio return and withdraw 4% of their portfolio every year in retirement to live on, a rough estimate puts you at being able to retire in 41.7 years.

Networthify's Early Retirement Calculator - 10% Savings Rate at $55,000 annual income

That sounds like a reasonable length of time to work. People buy into that. If you started full-time work at 25, you'd be retiring at 67. Sure, why not, I mean, that's just what you do right? Work 40+ years?

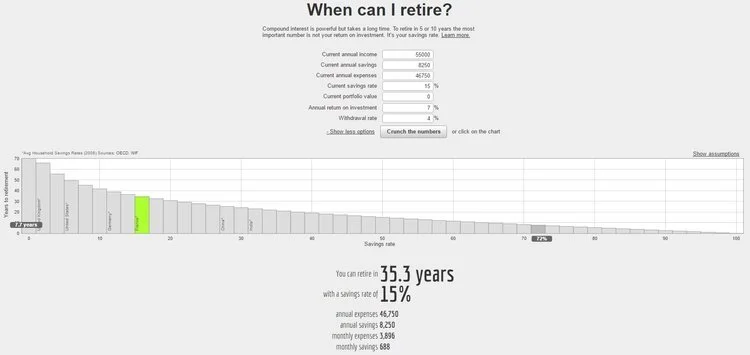

But what if you take a hard look at your spending decisions and what your true needs are, finding gratitude in the fact that it's actually quite incredible that you own a motorized piece of metal on four wheels that can take you places 30 times faster than you'd otherwise have to? Suddenly, keeping up any sort of image with extraneous things like looks, brand, and bells and whistles doesn't seem as important. And you decide you can do without buying a brand new car every few years. Let's say choose to buy used cars with better fuel efficiency, decreasing your spending rate down to 85%. This increases your savings rate up to 15%. How soon can you retire now?

Networthify's Early Retirement Calculator - 15% Savings Rate at $55,000 annual income

Just by cutting out 5% of spending that doesn't bring you that much happiness anyways, you could retire in 35.3 years, giving yourself over 6 years of your life back where you don't have to work?! Yes PLEASE!

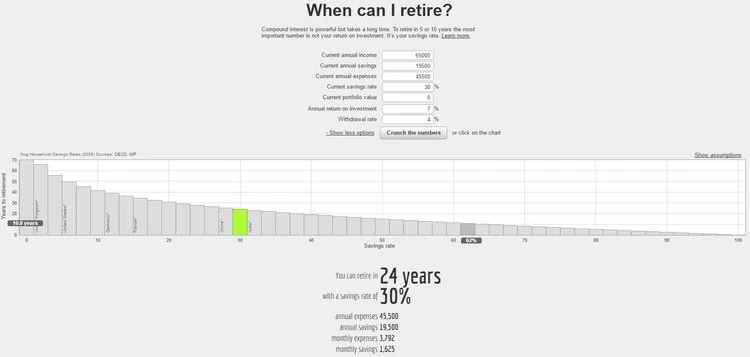

Let's go a step further. Let's decide that you really don't need to pay for 500 channels of cable TV, when you only watch 5 of those channels, and that you'd rather spend your time with healthier alternative hobbies rather than rot and grow fat on the couch. In addition to that, you decide that you can cut down on new clothes by half and, surprisingly, still be happy and have friends and family who love you and don't care that you now don't buy new clothes twice as often as you used to.

And, at the same time, let's say you got a promotion, raising your income by 18% up to $65,000 per year, but you decided to keep all your other living expenses the same.

Now, you've actually decreased your spending rate to 70%, and increased your savings rate to 30%. What does that look like now?

Networthify's Early Retirement Calculator - 30% Savings Rate at $65,000 annual income

Retire in 24 years?! SHUT THE FREAKING FRONT DOOR! You could buy over 15 years of your life back where you don't have to work. If you started this at 25 years old you could retire at 49. Before you're even 50 years old.

Obviously, there are several other important considerations like investing correctly, life expectancy, tax rates, and strategic contributions, but the fundamental math of early retirement.

IT'S NOT JUST ABOUT RETIRING EARLY - IT'S ABOUT FINANCIAL INDEPENDENCE

But you know what's completely liberating about the prospect of early retirement? It's that you don't actually have to stop working. You could work half-time instead, or in a dream job that's all fun and games. Maybe it's even a lower-paying job, but so highly satisfying that it makes you super giddy to wake up each day and go to work.

The beauty of it is that once you reach this point of having a portfolio big enough to sustain you with adequate income for the rest of your life based on the standard of living you've chosen, you don't have to work any more if you don't want to.

Do you realize how much that can change the whole outlook of your life and how you feel when you wake up every morning? That you could still go to work every day if you want to, but you don't have to?

This, my friends, is what you could call financial freedom. The smart ones out there who understand and live this principle of a high savings rate call it "Financial Independence."

The reality is, being grateful enough for what you have and developing a real awareness of what it takes to be happy can lead you a conscientious, permanent reduction in your spending rate.

I'd say that for most people, a chunk of their discretionary income (whatever money is left over after taking care of absolute bare essentials) is often used toward things that don't align with what they say would make them the most happy.

Striking this balance between enjoying the "now" AND securing the "later" by aligning your spending decisions with your values is part of living in Wealth Mode.

THE THANKSGIVING CHALLENGE

Wealth Mode's "Thanksgiving Challenge" to you all is to do a legitimate "Gratitude Exercise" to appreciate how little you truly need to be happy. Challenge your notion of what expenses you think of as "needs" that are really just wants. I gave some examples up above, but those weren't meant to insinuate that you shouldn't buy new cars or get cable TV.

They are, however, examples of expenditures that are beyond a "need", and the important thing is that you choose for yourself where to apply these tradeoffs. Re-assess your current standard of living and ask yourself if there are lifestyle choices that are costing you continuous, ongoing spending without providing any real, added happiness.

It's those very things that you could convert into savings and investments instead, buying more of your life back in the future via financial independence - and perhaps even early retirement.

Attitude of gratitude, y'all. Make it happen.