Wealth Mode Planning

Ongoing Services

Starts at $150+ /month

See pricing examples in the last section of this page.

Continuously monitor your finances and get advice for everything in your life.

Includes semi-annual meetings, open email and text support; year-round touch points for your investments, taxes, and other items; and self-scheduled extra check-in calls.

Quoted in advance based on needs and complexity.

Designed to be affordable and appropriate for your needs and situation (see pricing examples below).

Monthly billing begins after the completion of a Financial Plan service.

Keep your plan current and receive ongoing advice.

Follow through on action items.

Stay on track toward financial independence.

How it Works

Start with a Financial Plan.

Before starting ongoing financial planning services, you must first complete a Financial Plan service. A Financial Plan service is sometimes performed as a One-Time Financial Plan, where a client does not intend to continue working with us on an ongoing basis.

If you commit to ongoing services in advance, your Financial Plan will be an Upfront Financial plan that will be discounted about 10-20% off your quoted amount compared to a One-Time Financial Plan. This is to create an incentive to commit to Ongoing Services from the beginning, and also because a One-Time Financial Plan takes more work for us: when a client is not planning on working with us, we document and record much more commentary into your final plan deliverables so that you have extra material to refer to in the future based on the advice we gave you.

After we finish the the Financial Plan meetings, you’ll start your monthly billing for Wealth Mode Planning ongoing services.

Semi-annual meetings.

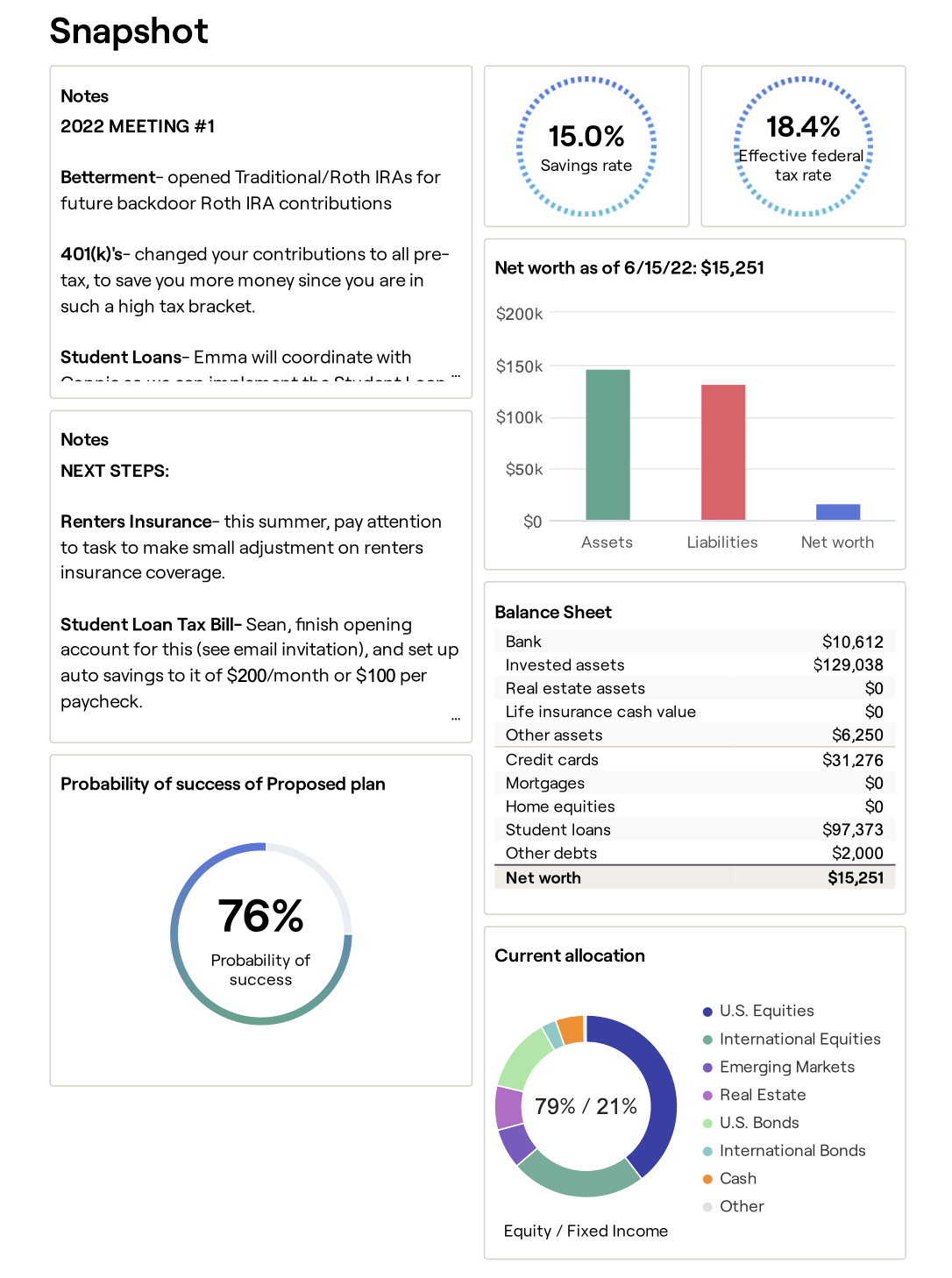

Every year we will hold two main Semi-annual meetings to make sure that we are proactive about your situation and handle important life decisions as they arise.

We’ll check on the progress on any financial to-do items we’ve assigned to you, and you’ll update us on changes in your life, job, or goals.

Task Reminders.

In today’s busy world, it’s too easy to procrastinate. And sometimes, that extends to your finances.

By using the RightCapital mobile app, you’ll get push notification reminders about important financial Tasks that we assign you based on our meetings and email conversations.

Unlimited email and text support.

Message us any time if you need help or clarification on tasks you’ve been given, or if you have a question come up. We’ll often respond back to your questions or inquiries with personalized video messages to be as clear and detailed as possible.

Self-schedule service calls as needed.

Sometimes, it’s better to converse about an important topic rather than communicate over an email or text chain.

Service Calls are extra “mini check-ins” in between your two main semi-annual meetings. You can self-schedule them straight from the Clients page of our website.

Additional service touch points.

Most people tend to underestimate how much work goes into maintaining and monitoring a financial plan.

Based on your situation, there will be other touch points we will provide support or updated advice on each year:

Annual net worth check reports

401(k) and investment account rebalance or allocation instructions

Student loan IDR recertification

Employee benefits open enrollment window

End-of-year tax planning

Ready to book your Free Intro Call?

The pricing examples below are illustrative estimates only. Each client is given a personalized quote after a thorough introductory discussion.

Pricing Examples

-

Recent College Graduate / Single Professional

- $90,000/year income

- 401(k) and Employee Benefits

- Student Loan Debt of $100,000 or more

$1,500 Financial Plan

$150/month Ongoing Advice

-

Dual Income Couple

- $200,000/year income

- Both have $100k+ student loans

- Two employee benefits programs

- Own home or planning to buy soon

- Optimized savings strategy between 401(k)’s, IRA’s, and brokerage accounts

$2,800 Financial Plan

$250/month Ongoing Advice

-

Higher Income Household

- $300,000+/year income

- Business owner / self-employed with associated tax planning needs

- Children with college or other future savings goals

- Taxable investments and/or real estate property

$4,000 Financial Plan

$350/month Ongoing Advice

-

Business Owner with Family

- $500,000+/year income

- Primary source of income is business owner / self-employed with complex tax planning needs

- Outsourced or collaborative personal CFO type services for business record-keeping and financial management

- Personal and business tax return preparation (paid separately)

- Taxable investments and/or real estate property$8,000 Financial Plan

$1,000/month Ongoing Advice