Should I Pay Off My Mortgage Early or Invest Extra?

EXTRA PAYMENT POWER

Pick up almost any mainstream book or listen to any talking head in the personal finance space and you'll hear "pay off your mortgage early."

The mathematics of extra principal payments is indeed staggering. You've heard it before: on a 30-year mortgage with a 4% interest rate, making one extra P&I payment per year will cut 4 years and 2 months off of your loan. That saves you tens of thousands of dollars in interest.

On a $250,000 loan, it would be over $21,000 saved - not too shabby!

You can easily make one extra mortgage payment per year simply by entering a bi-weekly payment plan with your mortgage servicer (though you're probably better off just sending in the extra principal payment manually, as explained here).

So if you have extra money each month, should you pay extra toward your mortgage?

The "right" answer may surprise you.

OUTDATED ADVICE?

While it sounds good on the surface, mathematically speaking it's actually better to invest extra money instead.

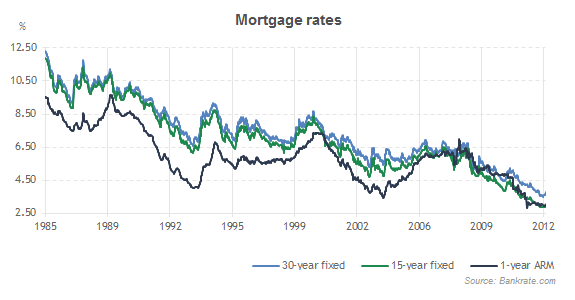

This is because you can earn a higher rate of return on your investments than you are paying on your mortgage. Right now, mortgage rates are just coming out of their lowest period in history.

If you can earn even a 7% rate of return on your investments in the long-term, why would you put extra money toward your mortgage just to save yourself from paying a 3.5% rate?

If you look at the table below, you'll notice that there was a time in the not-too-distant past when mortgage rates were double digits. That means every extra principal payment you made on a mortgage was saving you from paying 10+% interest on your loan.

When mortgage rates are as high as they were before the 2000's, you're paying such high interest that it's a no-brainer to pay extra on your mortgage.

Just in case this concept is new to you, let me put it into an easy example. Let's say you've borrowed $100 from someone at 3% weekly interest. You owe them $103, due by next week.

You buy what you want with the borrowed money, go sell some lemonade, and make $100. You can either pay back your loan now and pay the $3 of interest next week when it's due, but you're also told if you invest your $100 you can get 7% by next week. That means if you invested your money for a week and earned another $7, you'd be able to pay your $103 next week and still have $4 left over.

Extrapolate this concept over 30 years, and you're compounding your money faster in your investments than the amount of interest you have to pay to your creditors.

AND AN INFOGRAPHIC SHALL TEACH THEM

If you're like most people, what I just said now "kind of makes sense" conceptually but it still might help you to see the math laid out.

So let's look at an infographic that walks you through how you can end up with higher net worth in the long-run if you invest extra money rather than make extra payments on your mortgage principal.

Let's say you buy a $200,000 home with a 10% down payment, so your mortgage loan is $180,000. It's a 30-year mortgage at 4% interest. This means your principal and interest (P&I) payment is $859.

Source: Zillow Mortgage Calculator

Let's also say you're taking my advice to save more than 10% of your income, so beyond your 401(k) contributions and savings toward an emergency fund you have an extra $200 per month you're trying to figure out what to do with.

For a lot of people, it can be narrowed down to two options: pay extra toward your mortgage each month, or invest it for the long-term.

After 40 years, look carefully: which choice leads to a higher net worth? (If you take the time to digest the infographic I promise you'll have an "a-ha!" moment).

FINAL ANSWER?

So is my final answer that you should always invest any extra money you have rather than pay extra on your mortgage?

Not necessarily! Mathematically speaking, it could be deemed the "right answer", but there are several variables that could change what's best for you.

First off, there is no guarantee that you will earn what you are projecting on your investments. You may expect to earn 7% or more, but the fact is all investing comes with risk, and you don't know what's going to happen. Meanwhile, your mortgage interest rate is contractual. You have a set interest rate (assuming it's a fixed-rate loan), and every extra principal payment you make is guaranteed to save you money at that rate!

Secondly, you may have personal or religious values that encourage you to get out of debt as quickly as possible. And if that's the case, do it. The worst thing you can do is make financial decisions that are in conflict with your beliefs. Sometimes, achieving peace of mind is more important than being perfectly efficient with your wealth.

Thirdly, there are two variables that change how more you come out "ahead" for investing extra money instead of extra principal payments: 1) the length of your mortgage and 2) the proportion of your extra payment you can make to your P&I amount. It's important to calculate the scenarios for your own situation to find out how much the benefit will be, and from there decide which route you prefer.

If anything, recognize that financial planning is about navigating a fine balance between numbers and emotions. What feels emotionally natural can sometimes ransack you financially (like buying high and selling low), while what makes more sense on paper financially may give you more stress than it's worth (like staying in debt on your mortgage longer in order to redirect extra money to investments rather than your mortgage principal).

The best answer to each decision, of course, lies somewhere in between those two extremes.