The 3 Real Ways to Cut Expenses

BEFORE YOU READ:

Are you serious about reducing expenses so you can save more money? If so, then watch this video as you follow along with the slideshow.

CUTTING LITTLE EXPENSES IS BIG WORK

At some point in your life you've probably had a much-needed epiphany about how expensive life has become for you.

And then you think about how you don't save money. Or you know it's not enough. It always ends up being spent on something.

You may have tried in the past to motivate yourself and live more frugally. Maybe you looked up lists like "10 Ways to Cut Expenses" and started 3-minute cold showers, always turning off all the lights in your house except for the room you're in, and setting your thermostat to 60 degrees in the winter.

But that lasted like two days because you realized you kind of like hot water, being able to see what you're doing, and not needing multiple layers and a blanket just to be indoors.

So then you tried things like taking 10 hours per week you don't have clipping coupons like a deal-obsessive maniac on Extreme Couponing, but you got burned out again.

Ultimately, these kinds of efforts are honorable. But you're essentially using up a lot of time and mental strain to execute a bunch of little actions that might yield $100/month of savings.

$100 per month is great, but it ain't gonna make you a millionaire.

THREE CHOICES EAT UP MOST OF YOUR SPENDING

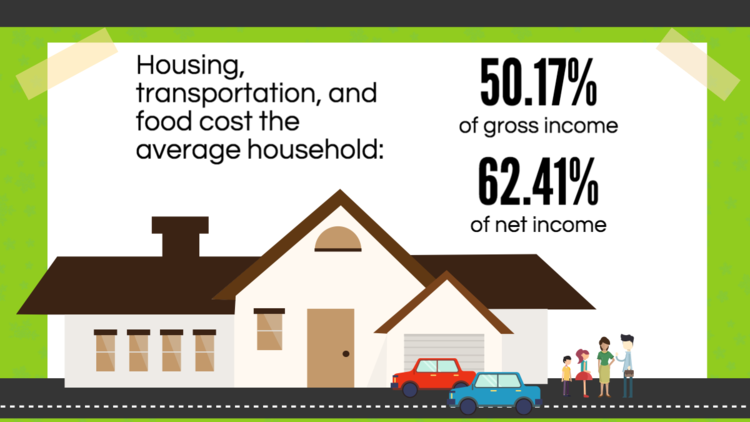

There are three spending categories that take up over 50% of the average household's gross income, and over 62% of the average household's net income. That's a gigantic slice of yo' money pie. Like almost two-thirds gigantic.

What are those three spending categories? Let's turn to the Bureau of Labor Statistics, whom we can evidently rely on for eye-catching design in their presentation of average consumer expenditures:

Oh barf, I know. Do they try to make things boring to look at? Fear not, I've turned the important figures into a snazzy infographic.

Another way to frame this reality is that you have three major lifestyle choices that cause you so much in expenses that they will largely dictate your ability to save money. Therefore, you should candidly assess how much you're spending due to your choices in these three areas. If it's admittedly too much, you have to have the courage to make changes for the sake of your financial future.

That's why I call it "the three-item gut check."

THE THREE-ITEM GUT CHECK

When I work with clients in a Cash Flow Coaching engagement, I help them set up a budget and share strategies to help them manage their money better. But I also invite them to do a "gut check" about three really big life decisions.

Here are those three really big life decisions:

Where You Live

What You Drive

How You Eat

Let that sink in.

You may be extending yourself on these spending categories to the point where it breaks your ability to save. And saving money's sorta important, cause, well... whether you save consistently or not determines if you will ever build your net worth and live in Wealth Mode.

Let me flesh through how those three decisions pervade pretty much your entire financial life.

WHERE YOU LIVE: HOUSING

The average American household spends over a quarter of their gross income on housing - 26.44%. This includes not just your house payment, but utilities, furnishings, and maintenance.

By "Where You Live", I'm referring to a few points:

The Cost of Living of Your Area - some areas of the U.S. just aren't as favorable in their ratios of cost-of-living to income levels. Choosing to live in an expensive area of the country often correlates with higher state and local taxes. Taxes = goodbye, my money. Goodbye.

The Location of Your Home in Your Locality - even within certain cities, some neighborhoods are way more expensive than others mostly due to social image. The crime statistics, quality of schools, and distance to shopping malls and convenience stores may not be all that different, but homes are worth 20% more just ... because. I'm not going to get into a discussion of social cliques and "Keeping up with the Jones's" here, but it applies.

The Proximity of Your Home to Where You Work - this is a double-doozy because it affects how much you pay in commuting costs in terms of time and money. The closer you live to where you work, the less you spend on fuel and/or public transportation. Also, the closer you live to your job, the more time you have in your day for you, instead of sitting in rush hour traffic or a smelly bus. Time is money, and studies show that those who spend less time commuting are happier and healthier.

The Size and "Quality" of Your Home - this one's a tough one for people to swallow. There's no right answer for everybody, but did you "take the bait" on your mortgage and buy a home at the maximum purchase price you qualified for? Or do you pay out the nose to rent in the shiniest, swankiest apartments in town? Those are the extremes, but ask yourself if you've justified newer, bigger, or nicer at the expense of not being able to save any money.

On the other hand, an older home may have more in the way of maintenance and upkeep, while newer homes may have lower utility costs because they're energy efficient.

I'm not trying to tell you that you have to live somewhere you don't like. But living somewhere that is more affordable, even though it's not perfect, is better for your finances. Take a serious look at your housing, since a change in your housing could be an instant way to reduce your expenses by 10% or more.

WHAT YOU DRIVE: TRANSPORTATION

Cars are a money abyss. Plain and simple. They're depreciating assets, so they don't gain value over time. An auto loan or lease payment is almost always the second biggest bill in your life after rent/mortgage. Cars require sales tax at purchase, interest during the loan pay-off period, ongoing insurance, annual registration and licensing, and repair and maintenance.

That's why transportation comes in 2nd place with an average spending per household of 13.65%.

This is a touchy area for a lot of people. We live in a car-lovin' society. Automobile brands carry their legions of followers and enemies, each claiming superiority for their favorite. Cars are a huge source of social image and reputation, or more accurately, a fake indicator of wealth, happiness, or satisfaction. So, we pay a huge premium for more expensive cars when they functionally do no more than any other car - get us from Point A to Point B.

Question "what you drive" with the following:

New vs. Used - there's sort of an argument to be made for newer cars, but it doesn't hold up that well. Generally speaking, buying a slightly used car is the best bang for your buck due to the quick depreciation on a new car in the first couple years.

Fuel Efficiency - Jeeps and trucks and sports cars are great, but only if you can truly afford them. Otherwise, say hello to high loan payments and large refills at the gas pump. If you have any sort of long-ish commute and you have a low MPG car, reconsider what's best for you in the long run.

Reliability - we suffer terribly from selective memory, and are very biased toward limited anecdotal experience. Everyone swears by a certain make or model of car to be the best choice, usually for very subjective reasons. If our uncle had a certain model car that lasted for 20 years and never had a major repair, we hang our hats on that model. I say one person's car is a small sample size to be confident about, and yet people form strangely strong opinions on what the most reliable car model is.

Want to be completely objective? Check out Consumer Reports' annual car reliability guide. This is independent consumer research that will show you which car models have the lowest probability of problems based on real numbers reported by car owners. This is a much more dependable source than biased reports by manufacturers themselves, or what you've seen with a few friends' or family members' cars in your life. Buying a reliable model will create a difference of thousands of dollars over the life of that car.Number of Cars - our culture conditions us to think every adult needs a car. For couples - can you go without two cars? If you can find a way to make one car work, do it. That's one less auto insurance payment, one less registration payment, several less trips to the mechanic, and way less trips to the gas station.

Ongoing maintenance - most of us don't budget for car maintenance. We just cross our fingers and hope it's a long time before something happens and we have to get a repair. Some mechanics give a rule of thumb to save $100 per month per car if you don't know what your ongoing costs have been. Another awesome tool is Edmund's True Cost to Own® calculator. This projects how much a specific model will really cost you over time if you are about to buy a car.

If you don't own a car because you live in an urban area with good public transportation, congratulations! You don't have to participate in owning a money-sucker, and spend on average a third as much on transportation as car-owners.

HOW YOU EAT: FOOD

Apparently, in 2015 Americans hit a turning point. We're now spending more money on eating out than we are on groceries. That is based on a total of dollars spent - probably driven upwards by the costly restaurants, bars, and wineries frequented by the mega-wealthy and by everyone else on business trips - but even the average spending on eating out per household is getting close to overtaking spending on groceries.

Out of the average 10.09% of our budget we spend on food, 5.77% is "food at home" and 4.32% is "food away from home."

A survey from last year revealed that the average American eats out 4.5 times per week. That's 19.5 times per month, 234 times per year. Assuming three meals a day for 365 days a year for 1,019 meals annually, the average person eats out once every five meals.

That means 20% of our meals - eating out - accounts for almost 43% of our spending on food.

More recent surveying suggests that it's we Millennials who are driving up that average. Food Network says we eat out more often and spend more when we do.

When it comes to doing a gut-check for your food spending habits, check your gut and realize it will be okay with homemade food too.

LIFESTYLE GUT CHECKS AREN'T EASY

Lifestyle gut checks are hard. From my experience in helping people with their finances, I've found that people usually know when they need one, but it's easy to ignore the feeling, not think about it, and procrastinate a change.

I think being overextended in these three areas - where you live, what you drive, and how you eat - is a major reason why the average personal savings rate in the U.S. struggles to clear 5%.

I realize that many of you reading this may already feel like you are fairly frugal in these lifestyle choices. That's great - way to be! If you've done this gut check (or never had to) and still find saving money difficult, you may need to set goals for the other half of the equation: increasing your income.

One of the main tenets of living in Wealth Mode is that your lifestyle choices are in-line with your values and allow you to enjoy the "now" (spending) while not putting your future at risk (saving). This balanced state of financial nirvana isn't easily achieved, but the three-item gut check is an enlightening place to start.